Working from home - are you covered?

The speed at which the Australian workforce was moved from offices across the country to the work from home environment is breathtaking. This means most people probably gave little to no thought to their personal insurance policies and the cover they offered.

The two most important considerations when it comes to working from home are exclusions for home office contents and public liability insurance.

Home office

These days, most people will have some sort of computer and internet set up at home for personal use. You or your partner, may also work from home part time. Or perhaps you may work from home full time.

You might have a dedicated area of your home set aside just for business or you may run your business from the corner of the kitchen table.

Generally, if you use any part of your home solely for business use, it’s unlikely to be covered by your personal home and contents policy. This includes but is not limited to:

- a bedroom or study that is set aside and used solely as an office

- a garage

- a purpose-built hut or granny flat type dwelling

- a shed

- an area of the house designated for business use only

If you suffer loss or damage to any part of your home used exclusively for your business, it may not be covered under your general home and contents policy.

If you or your partner only use the space part-time, your policy may offer some sort of limited cover. Check with us as your broker or ask your insurer and read your PDS to see what cover they’re offering.

Home office contents

Similar to the cover offered for your building, policy coverage for contents items used for your business will vary depending on things such as:

- is the item used for business purposes only?

- what percentage is the item used for personal and what percentage for private use?

- is the item for personal use and only very occasionally used for business?

Not all contents policies are attached to home insurance policies, such as those who rent, travel or live with other family members, so the above also applies to stand-alone contents insurance policies.

The great news for contents insurance policyholders is there’s usually a bit more flexibility within these policies. Most will offer limited cover for contents items that are used for business purposes. The limited cover is usually an exact dollar amount rather than a percentage amount. Accountants enjoy working with percentages, insurers not so much.

Every insurer and every policy is different so, as always, we suggest you ask or read your PDS thoroughly.

Public liability insurance

With the current coronavirus crisis, having people in your home for business is not, and should not, be an issue due to social distancing measures. But this crisis will pass (hopefully quickly) and when it’s back to business as usual, public liability insurance may be cause for concern.

Perhaps you will have enjoyed working from home. You may find an environment without distractions has made you extremely productive, or you may want to go back into your office a few days a week only.

Or maybe working from home is now your new reality longer term.

Whatever the reason, public liability insurance is very different to home and contents insurance. For a start, your personal home and contents policy will have public liability cover, usually up to $20M, for private use only. It will exclude anyone on your property for business reasons. And you’ll find there’s no flexibility to this cover.

If you’ll be having people at your home in the course of you running your business, you must take out a business public liability insurance policy. There’s no way around it as you want to ensure you are covered for anyone who might injure themselves while seeing you during the course of business.

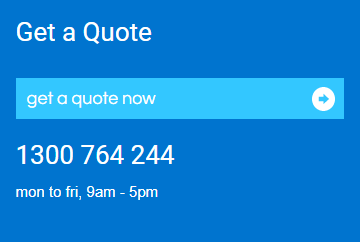

If you’d like to chat with us about your current policies, or to set up new policies, please contact the cgib team today.

The information provided in this article is general advice only, and is not intended to be a substitute for legal or other advice. General Advice is advice that has been prepared without considering your current objective's, financial situation or needs. Therefore, before acting on this advice, you should consider the appropriateness of the advice having regard to your current objective's, financial situation or needs. Read our complete general advice warning

Tags: Public Liability