How to get the full value out of your insurance broker

As an SME, you’re always looking for a better deal for insurance to protect your business, its assets, and liabilities. This article explains how an insurance broker or adviser's expertise can optimise your coverage within your budget and risk profile.

The Great Insurance Squeeze

Insurance premiums have increased 16.2% over the past year, faster than inflation. More extreme weather events, escalating costs for building materials, and ebbs and flows in supply chain issues are cited as the reasons for the hike. There are also more claims.

This can leave you feeling like you have limited options: accept high premiums, underinsure your business, or go uninsured altogether.

But there's another way.

The Role of an Insurance Broker or Adviser

An insurance broker or adviser works for you and your business interests to advise on your overall insurance needs. They’re qualified and regulated. Typically, an insurance broker or adviser has at least a CIV qualification in insurance broking and may have to comply with the Insurance Brokers Code of Practice. The Australian Securities & Investments Commission regulates insurance brokers or advisers, saying they must provide their services efficiently, honestly, and fairly.

Typically, brokers or advisers can:

- Assist the client manage their risk through insurance cover or other mechanisms

- Provide risk management services

- Be a claims advocate when making a claim.

This is what the work of an insurance broker or adviser looks like for you:

- Conducts a risk/needs analysis then recommends coverage, sourcing best-fit insurance policies

- Offers risk management strategies to potentially lower premiums, such as paying a higher excess

- Helps you decide on your premium monthly or annually

- Provides prompt and responsive service

- Helps with claim forms, adjusters, and communication with insurers, and

- Negotiates the best possible claim settlement to help you maximise your entitlements.

Insurance brokers or advisers receive remuneration either as a commission payment from insurers or a fee paid by the client or a combination of both. We will advise you in our Terms of Engagement the remuneration we will earn. However, brokers or advisers can potentially save your business money by finding the best cover for your business and avoid costly gaps in cover or under-insurance.

How Brokers or Advisers Help Secure You the Best Cover:

Insurance brokers or advisers make sure they understand your business, risk profile and needs before recommending any policies. Brokers or advisers have expertise in varied industries and sectors so they can cover the range of risks possible.

Interpreting Policy Wording:

An everyday term can have a different meaning in an insurance context (flood and storm event, for one). You might think your business is ‘always covered’ because you pay insurance premiums. However, some policies aim to cover specific circumstances and scenarios plus all policies have conditions and exclusions. As your broker or adviser, we help you make sense of policy details, so you have the protection you need. Consider how much time it would take you away from your business to read and interpret a range of policies if you’re doing your own research.

Negotiating Claims Settlement:

Dealing directly with insurers can also be a time-hungry and bumpy process. A broker or adviser is your claims advocate, ensuring you receive your true entitlements under your policy and allowing you to focus on running your business. However, a broker or adviser managing your claim will know to ask the right questions to identify the best clauses to support you. We streamline the process so you can get back to running your business.

Competitive premiums

If your business has made multiple claims, your premiums may be high. That’s because insurers look at your history, risk profile and your business type to determine the premium. Having a broker or adviser to help you, particularly one who has insights into a diverse range of insurers, makes for a more time-efficient process of finding the best policy and premium. As well, we can negotiate on your behalf for a discount if you’re bundling policies together.

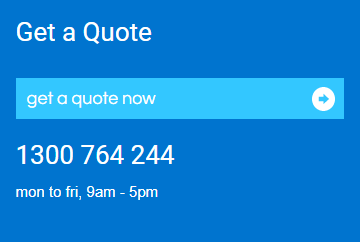

As your broker or adviser, we’re here to help your SME get the best possible outcome for your insurance coverage. Talk to us today.

Any financial product advice in this content is provided by cgib AFSL No. 231183. This material is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Accordingly, before acting on it, you should consider its appropriateness to your circumstances. cgib respects your online time and privacy.

Tags: Builders Building Designers Business Insurance Business Interruption Claims Commercial motor and truck insurance Cyber insurance General Homeowner Landlord Insurance Management Liability Plant and Machinery Professional Indemnity Professionals Public Liab